UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

☐ | Preliminary Proxy Statement |

☐

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒

☒ | Definitive Proxy Statement |

☐

☐ | Definitive Additional Materials |

☐

☐ | Soliciting Material Pursuant to § 240.14a-11(c) or §240.14a-12 |

| PAR Technology Corporation | |

| (Name of Registrant as Specified In Its Charter) | |

| | |

| (Name of Person(s) Filing Proxy Statement if other thanPAR TECHNOLOGY CORPORATION (Name of Registrant as Specified in its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | |

Payment of Filing Fee (Check the appropriate box):

☒

S | No fee required. |

| | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| 1) | Title of each class of securities to which transaction applies:. |

| | |

| | |

| 2) | Aggregate number of securities to which transaction applies: |

| | |

| | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| 4) | Proposed maximum aggregate value of transaction: |

| | |

| | |

| 5) | Total fee paid: |

| | |

| | |

☐ | Fee paid previously with preliminary materials. |

| | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| 1) | Amount Previously Paid: |

| | |

| | |

| 2) | Form, Schedule or Registration Statement No.: |

| | |

| | |

| 3) | Filing Party: |

| | |

| | |

| 4) | Date Filed: |

| | |

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

☐

Fee paid previously with preliminary materials:

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount previously paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

Karen E. Sammon

| Donald H. Foley

President and Chief Executive Officer | | | | | | PAR Technology Corporation

8383 Seneca Turnpike

New Hartford, NY 13413

| |

| | | | | | | | | |

| | |

| |  | | | | | | |

April 8, 2016

28, 2017

Dear Shareholders:PAR Technology Corporation Stockholder:

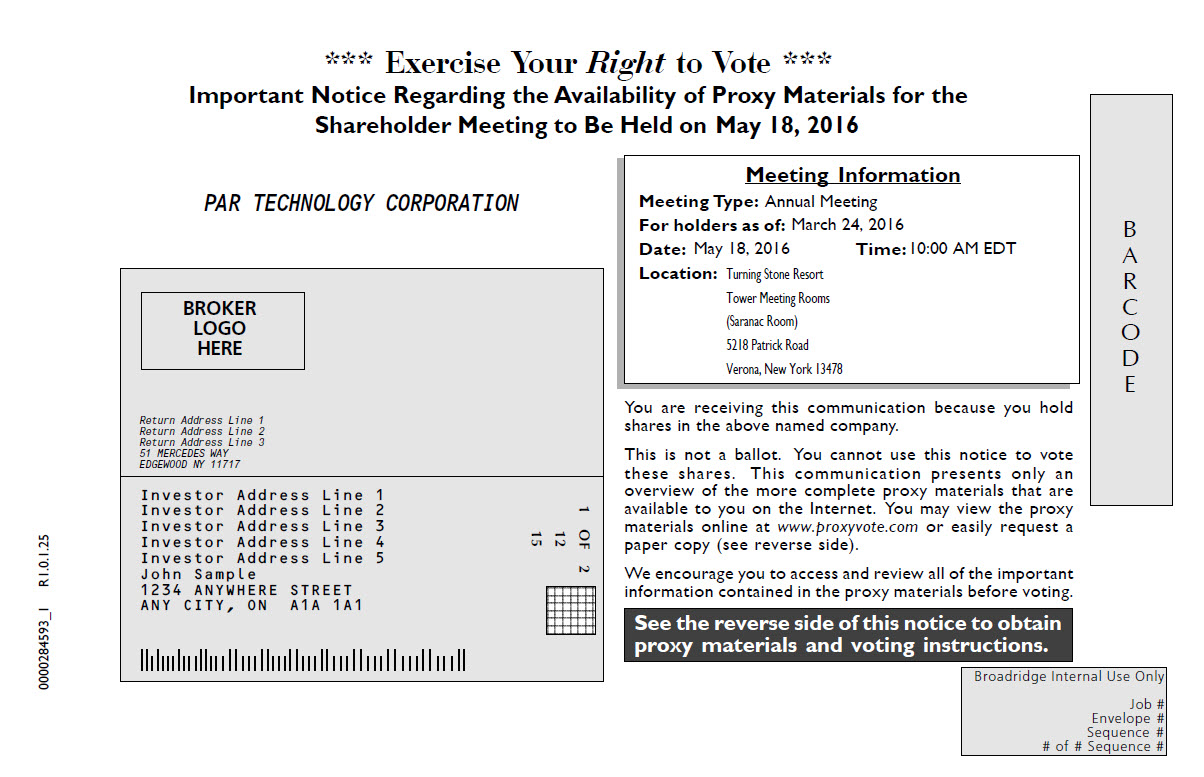

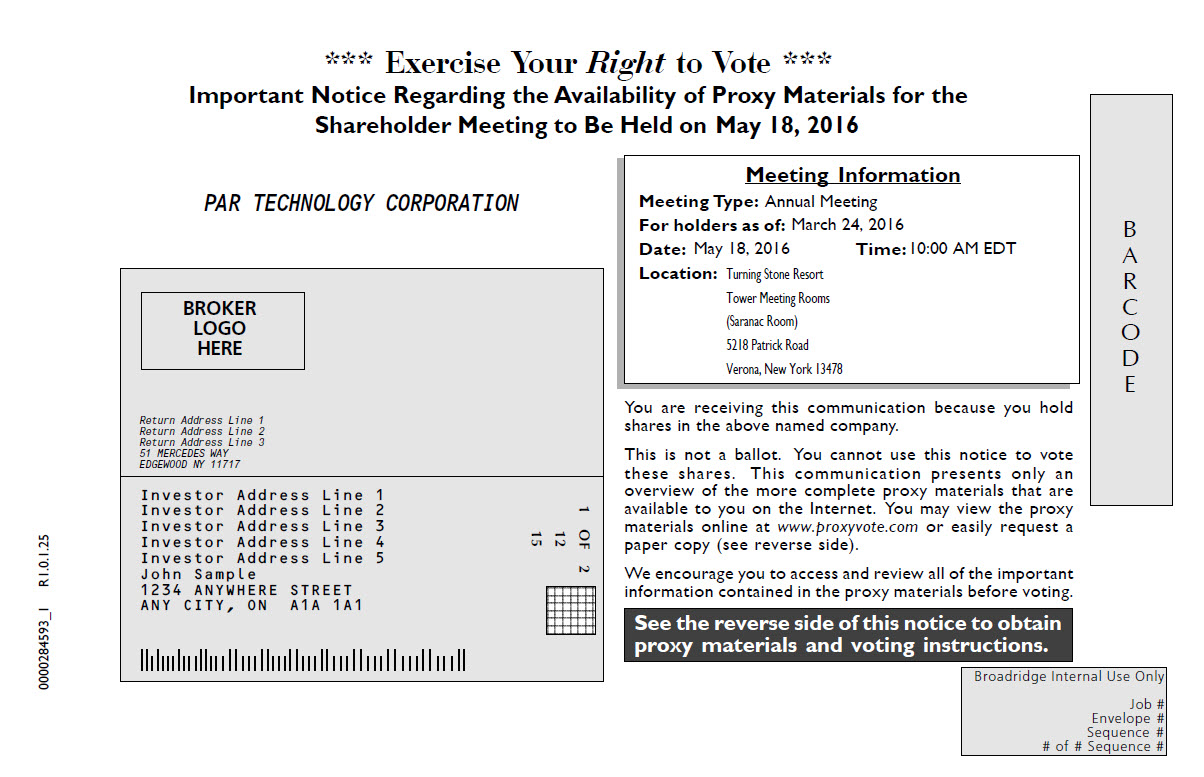

You are invitedI am pleased to attendinvite you to PAR Technology Corporation’s 20162017 Annual Meeting of Shareholders (the “meeting”) toStockholders, which will be held on Wednesday, May 18, 2016,Friday, June 9, 2017 at 10:00 AM,a.m. local time. The meeting will be heldtime at the Turning Stone Resort, Tower Meeting Rooms (Saranac(Birch Room), 5218 Patrick Road, Verona, New York 13478. During

At the meeting,Annual Meeting, we will present a report on PAR’s operations, followed by discussion of and votingbe electing five Directors, holding an advisory (non-binding) vote on the compensation of our named executive officers, and acting upon such other matters set forth inas may properly come before the accompanying Notice of 2016 Annual Meeting of Shareholders and Proxy Statement and discussion of other business matters properly brought before the meeting. There will also be time for questions.or any adjournments or postponements thereof.

This Proxy Statement provides information about PAR that is of interest to all shareholders and presents informationAdditional details regarding the business to be conducted are described in the accompanying proxy materials. Also included is a copy of our Annual Report on Form 10-K for 2016. We encourage you to read this information carefully.

It is important that your shares be represented and voted at the meeting.2017 Annual Meeting. Voting by proxy does not deprive you of your right to attend the Annual Meeting.

I sincerely hope you will attend our Annual MeetingAs discussed in the accompanying Proxy Statement, if your shares of Shareholders on May 18, 2016. Under New York Stock Exchange Rules,common stock are not registered in your name, but rather in the name of your broker, bank, or other nominee, in the absence of voting instructions from you, your broker, bank, or other nominee is not permitted to vote your shares on your behalf in an uncontested electionon any of directors or corporate governance matters supported by management unless you provide specific instructions. As a result, taking an active role in the voting of your shares has become more important than ever before. proposals to be considered at the Annual Meeting.

Whether or not you planexpect to attend the 2017 Annual Meeting, please vote over the telephone or the Internet or, if you canreceive a proxy card by mail, by completing and returning the proxy card, as promptly as possible in order to ensure your representation at the Annual Meeting. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials or, if you receive a proxy card by mail, the instructions are printed on your proxy card. Even if you have voted by proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, if your shares are representedheld of record by a broker, bank, or other nominee and you wish to vote at the meeting by promptly votingAnnual Meeting, you must obtain a proxy issued in your name from that record holder.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in PAR Technology Corporation.

Sincerely,

Chief Executive Officer & President

![[MISSING IMAGE: lg_par-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001174947-17-000690/lg_par-4c.jpg) PAR Technology Corporation8383 Seneca Turnpike, New Hartford, NY 13413-4991

PAR Technology Corporation8383 Seneca Turnpike, New Hartford, NY 13413-4991NOTICE OF

2017 ANNUAL MEETING OF STOCKHOLDERS

Dear PAR Technology Corporation Stockholder:

The 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of PAR Technology Corporation, a Delaware corporation (the “Company”, “PAR”, “we”, “us”, or “our”) will be held as follows:

Date:

Friday, June 9, 2017

Time:

10:00 a.m. (local time)

Place:

Turning Stone Resort, Tower Meeting Rooms (Birch Room), 5218 Patrick Road, Verona, New York 13478.

Record date:

April 24, 2017.

Items of Business:

To elect the five Director nominees named in the Proxy Statement to serve until the 2018 Annual Meeting of Stockholders;

To approve, on an advisory (non-binding) basis, the compensation of our Named Executive Officers; and submitting your

To transact other business that may properly come before the Annual Meeting or any adjournments or postponements thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on Friday, June 9, 2017 at 10:00 a.m. local time at the Turning Stone Resort, in Verona, New York. As of the date of mailing of the Notice of Internet Availability of Proxy Materials, all stockholders and beneficial owners will have the ability to access all of our proxy materials on a website referenced in the Notice of Internet Availability of Proxy Materials.

By Order of the Board of Directors,

Donald H. Foley,

Chief Executive Officer and President

New Hartford, New York

April 28, 2017

You are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please vote over the internet, by telephone or the Internet or, if you have requestedreceive a hard copy ofproxy card by mail, by completing and returning the proxy materials,card, as promptly as possible in order to ensure your representation at the Annual Meeting. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials or, if you receive a proxy card by completing, signing, dating and returningmail, the instructions are printed on your proxy formcard. Even if you have voted by proxy, you may still vote in person if you attend the prepaid envelope provided with the form.

Sincerely,

PresidentAnnual Meeting. Please note, however, if your shares are held of record by a broker, bank, or other nominee and Chief Executive Officer

Important Notice to Shareholders of Record

Internet Availability of Proxy Materials

for the Shareholder Meeting to be held at 10:00 AM local time on May 18, 2016:

The Proxy Statement, Proxy Card and the 2015 Annual Report on Form 10-K are available at:

www.partech.com/investors/proxy

You can access Internet voting at:

www.investorvote.com/PAR

You can access toll free Telephone voting at:

1-800-652-VOTE (8683)

|

IMPORTANT NOTICE REGARDING ESCHEATMENT LAWS: The Company has been advised that many states are strictly enforcing escheatment laws and requiring shares held in “inactive” accounts to escheat to the state in which the shareholder was last known to reside. One way shareholders can ensure their account is active isyou wish to vote their shares.

Printed Using Soy Ink

Recycled Content Paper

You are encouraged to elect and receive futureat the Annual Meeting, you must obtain a proxy materials via email. You can make this election by visiting the Investor Center at www.computershare.com/investor. If you are accessing this document on line, please consider the environment before you print. If you are reviewing a hard copy of this document, when you are finished, please be considerate of the environment and recycle.issued in your name from that record holder.

| | | | Page |

| iii |

| iv |

| | | | | 1 | | |

| | | | | 1 | | |

| 3 | | | | 5 | | |

| 3 | | | | 5 | | |

| | | | | 8 | | |

| | | | | 11 | | |

| 13 | | | | 12 | | |

| 14 | | | | 13 | | |

| 16 | | | | 15 | | |

| 16 | | | | 15 | | |

| | | | | 17 | | |

| 22 | | | | 21 | | |

| 24 | | | | 22 | | |

| 26 | | | | 23 | | |

| 26 | | | | 24 | | |

| 27 | | | | 24 | | |

| 27 | | | | 25 | | |

| 28 |

| 28 |

| 29 |

| 29 | | | | 26 | | |

This page intentionally left blank.

2016 Proxy Summaryii

This summary is intended to provide a quick source for information contained elsewhere in this Proxy Statement. This summary does not contain all the information a shareholder should consider and you are encouraged to read the entire Proxy Statement carefully before voting your shares.

Annual Meeting Information:

·Date and Time:

| Wednesday, May 18, 2016 at

10:00 AM, local time

|

·Place:

| Turning Stone Resort

Tower Meeting Rooms (Saranac Room)

5218 Patrick Road

Verona, New York 13478

|

·Record Date:

| March 24, 2016 |

Meeting Agenda:

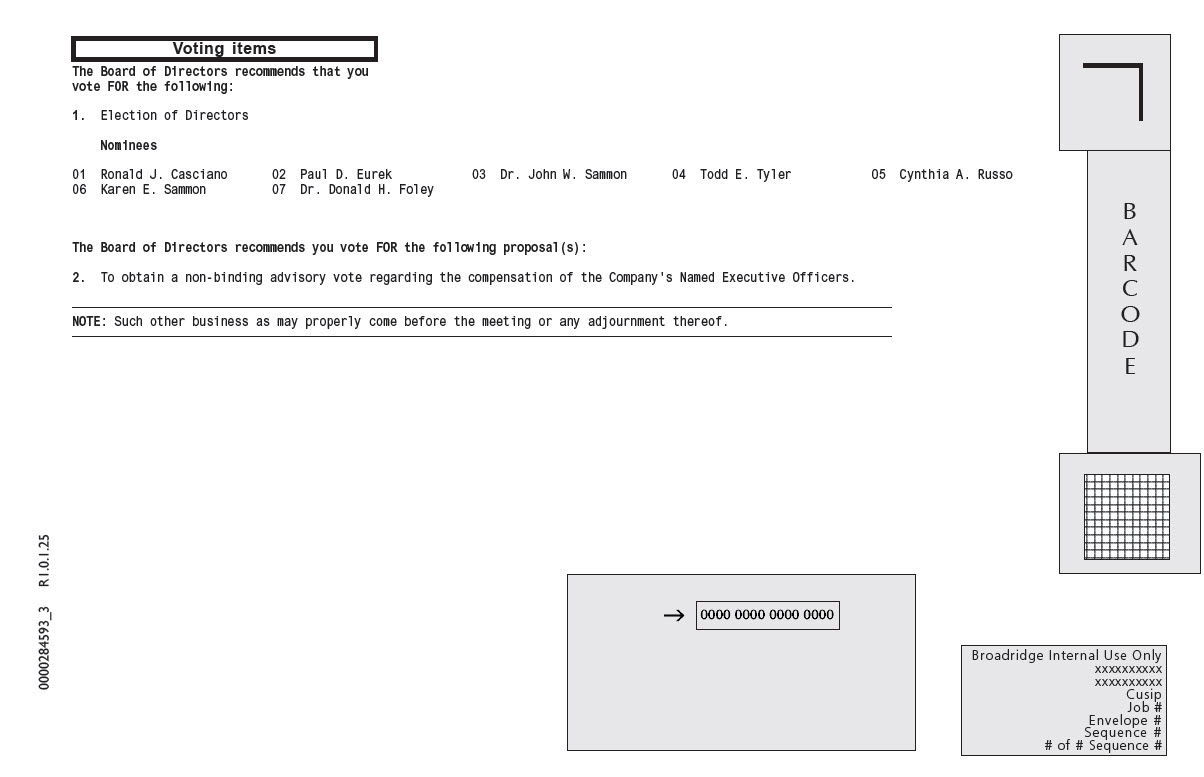

· | Non-binding advisory vote regarding the compensation of the Company’s Named Executive Officers |

· | Transact such other business as may properly come before the meeting |

Matters to be voted upon:

Matter

| Board’s

Recommended Vote

| Page Reference

for more detail

|

·Election of Directors

| FOR the Director Nominees

| 3

|

·Non-binding advisory vote regarding the compensation of the Company’s Named Executive Officers

| FOR | 27 |

iii

April 28, 2017

NOTICE OF 2016 2017 ANNUAL MEETING OF

SHAREHOLDERSSTOCKHOLDERSTo be held June 9, 2017TO BE HELD ON WEDNESDAY, MAY 18, 2016PROXY STATEMENT

Dear PAR Technology Shareholder:

The 2016 Annual Meeting of ShareholdersThis Proxy Statement is being furnished to the stockholders of PAR Technology Corporation, a Delaware corporation, (the “Company”), willin connection with the solicitation of proxies by our Board of Directors for use at our 2017 Annual Meeting of Stockholders to be held on Friday, June 9, 2017 at 10:00 a.m. local time at the Turning Stone Resort, Tower Meeting Rooms (Saranac(Birch Room), 5218 Patrick Road, Verona, New York 1347813478. This Proxy Statement and the proxy and voting instruction card are first being sent or made available to our stockholders on Wednesday, May 18, 2016,or about April 28, 2017.

INFORMATION ABOUT THE PROXY MATERIALS AND VOTING

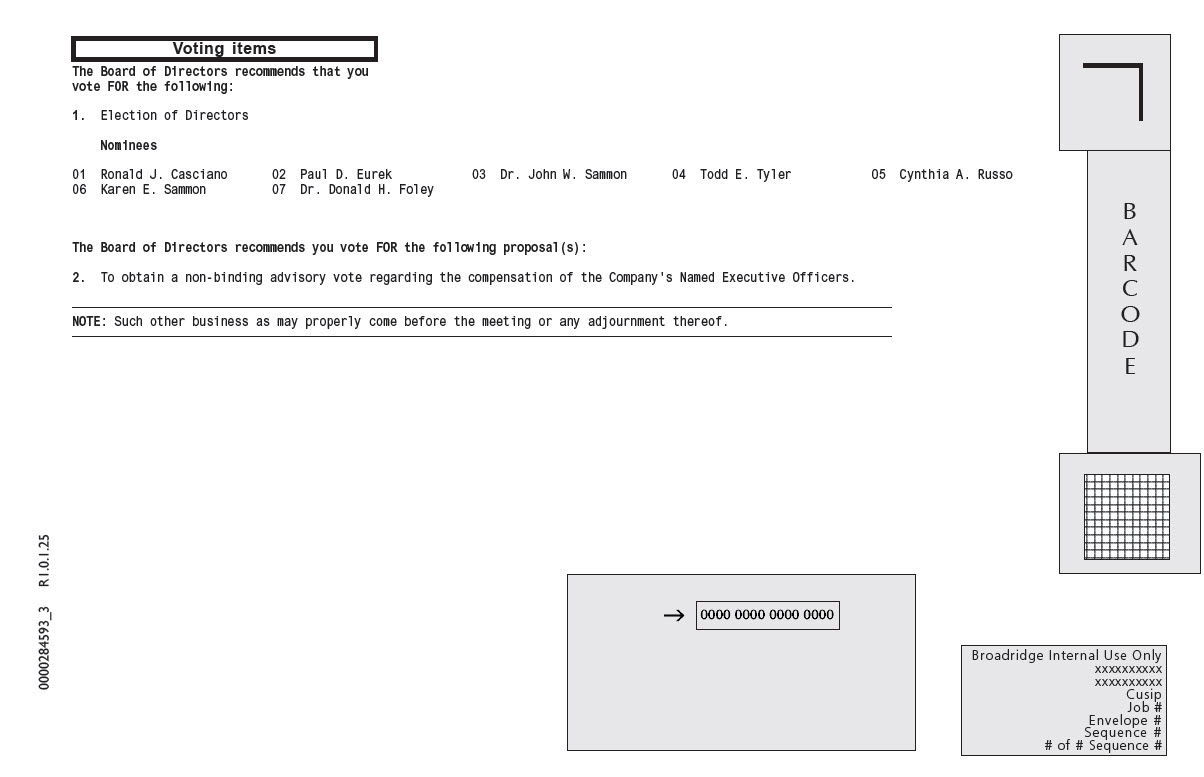

Who is entitled to notice and to vote at 10:00 AM, local time, for the following purposes:

| 1. | To elect seven (7) Directors of the Company for a term of office to expire at the 2016 Annual Meeting of Shareholders; |

| 2. | To obtain a non-binding advisory vote regarding the compensation of the Company’s Named Executive Officers; and |

| 3. | To transact such other business as may properly come before the meeting or any adjournments or postponements of the Annual Meeting. |

The Board of Directors has set March 24, 2016 as the record date for the Annual Meeting. This means that ownersMeeting?

Only stockholders of the Company'srecord of our common stock at the close of business on MarchApril 24, 2016 are entitled to receive this notice and to vote at2017, the Annual Meeting or any adjournments or postponements thereof. A list of shareholders as of the close of business on March 24, 2016 will be made available for inspection by any shareholder, for any purpose relating to the Annual Meeting, during normal business hours at our principal executive offices, PAR Technology Park, 8383 Seneca Turnpike, New Hartford, New York 13413, beginning 10 days prior to the meeting. This list will also be available to shareholders at the meeting.

Every shareholder’s vote is important. Whether or not you plan to attend in person, we request you vote as soon as possible. Most shareholders have the option of voting their shares by telephone or via the internet. If such methods are available to you, voting instructions are printed on your proxy card or otherwise included with your proxy materials. If you have requested a hard copy of the proxy materials, you may also vote by the traditional means of completing and returning the proxy card in the accompanying postage prepaid envelope. If you vote via telephone or Internet, there is no need to return your proxy card.

The proxy solicited hereby may be revoked at any time prior to its exercise by: (i) executing and returning to the address set forth above a proxy bearing a later date; (ii) voting on a later date via telephone or Internet; (iii) giving written notice of revocation to the Secretary of the Company at the address set forth above; or (iv) voting at the meeting.

| By Order of the Board of Directors, |

| |

| Viola A. Murdock |

| Corporate Secretary |

April 8, 2016 | |

This page intentionally left blank.

PAR Technology Corporation

8383 Seneca Turnpike, New Hartford, NY 13413-4991

April 8, 2016

FOR

ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of PAR Technology Corporation (the “Board”), a Delaware corporation (the “Company”), for use at the Annual Meeting of Shareholders to be held at 10:00 AM, local time, on Wednesday, May 18, 2016, at Turning Stone Resort, Tower Meeting Rooms (Saranac Room), 5218 Patrick Road, Verona, New York 13478 and at any postponement or adjournment thereof. The approximate date on which this Proxy Statement, the form of proxy and Annual Report for the fiscal year ending December 31, 2015 are first being sent, given or made available to shareholders is April 8, 2016.

Purpose of Meeting

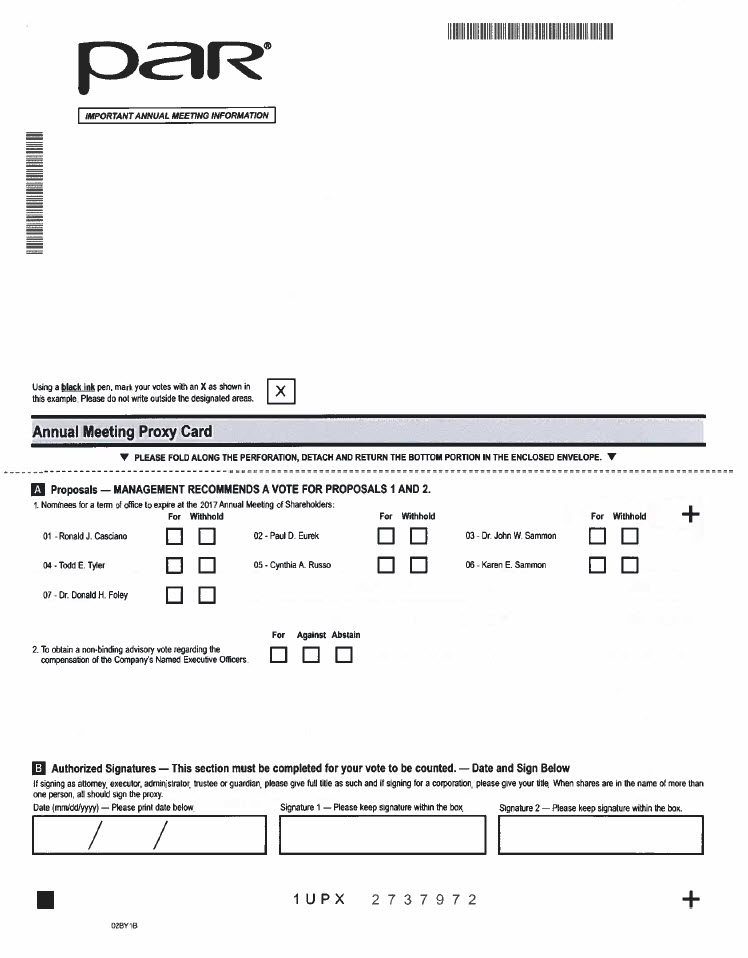

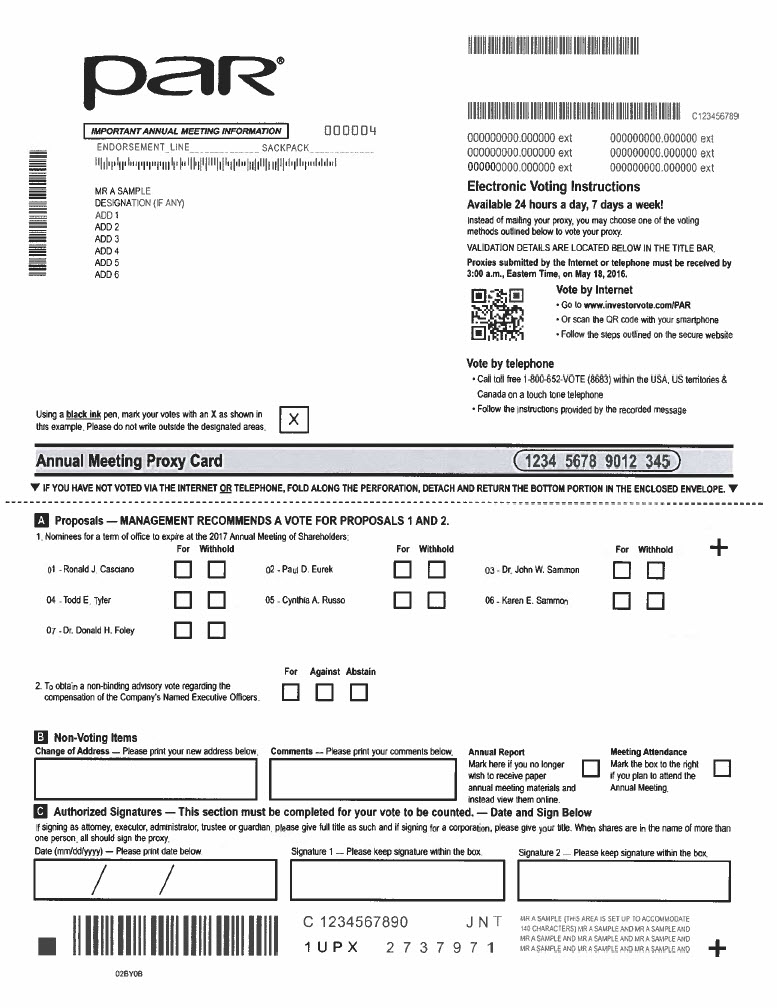

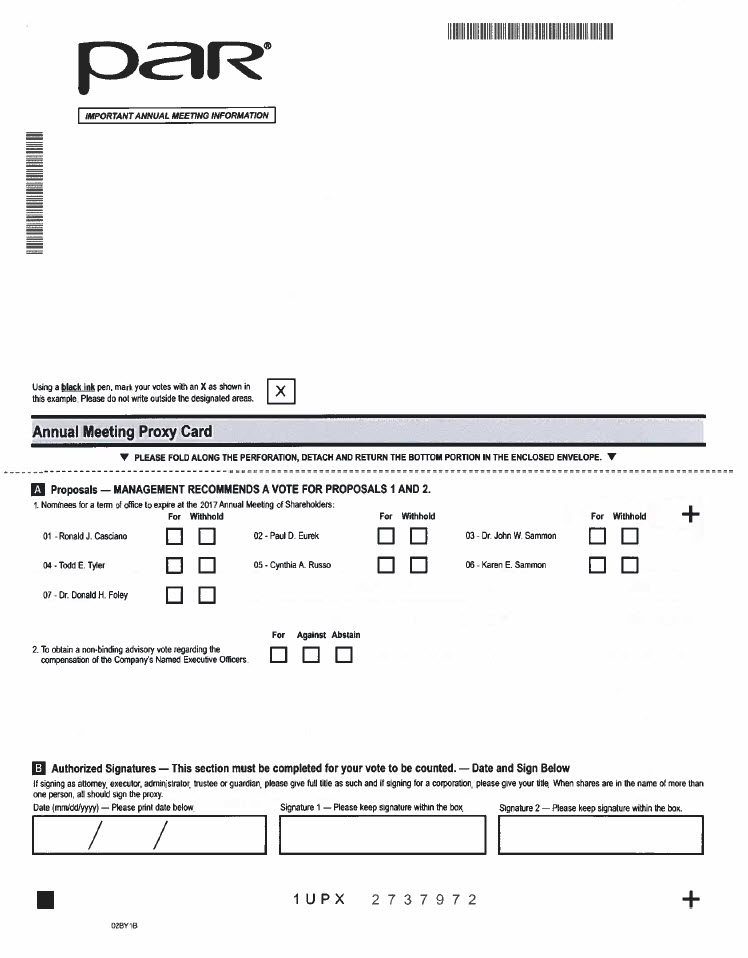

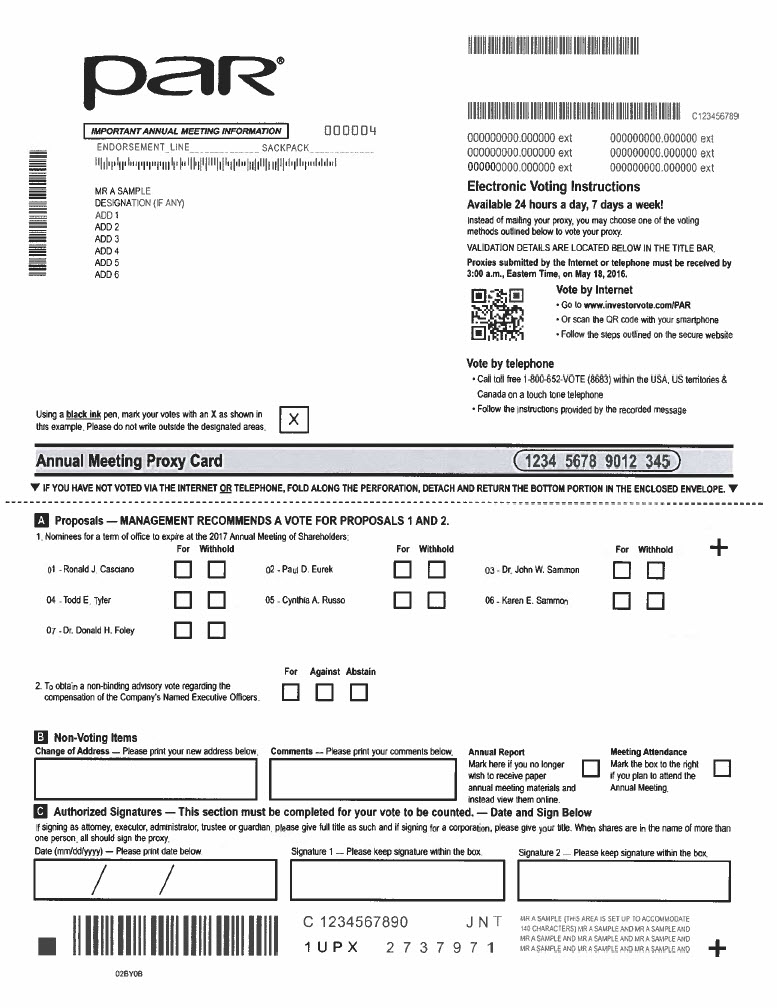

At the meeting, shareholders will be asked to consider and vote on the following matters:

| 1. | To elect seven (7) Directors of the Company for a term of office to expire at the 2017 Annual Meeting of Shareholders; |

| 2. | To obtain a non-binding advisory vote regarding the compensation of the Company’s Named Executive Officers; and |

| 3. | To transact such other business as may properly come before the meeting or any adjournments or postponements of the Annual Meeting. |

Each of the proposals is described in more detail in this Proxy Statement.

Record Date,

Only shareholders of record at the close of business on March 24, 2016 will be are entitled to notice of, and to vote at, the meeting or any postponements or adjournments of the meeting. As of that date,Annual Meeting. On April 24, 2017, there were 15,606,21115,774,604 shares of the Company's common stock par value $0.02 per share (the “Common Stock”), outstanding and entitled to vote. Treasury shares are not voted.outstanding. Each share of Common Stock entitles the shareholdercommon stock is entitled to one vote on all matters to come beforevote.

Distribution of Proxy Materials; Notice of Internet Availability of Proxy Materials (the “Notice”).

As permitted by the meeting including the electionrules of the Directors.Securities and Exchange Commission (“SEC”), on or about April 28, 2017, we sent the Notice to our stockholders as of April 24, 2017. Stockholders will have the ability to access the proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, on the Internet at www.investorvote.com/PAR or to request a printed or electronic set of the proxy materials at no charge. Instructions on how to access the proxy materials over the Internet and how to request a printed copy may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. The holders of shares representing a majority, or 7,803,106 shares, represented in personNotice also instructs you on how to vote through the Internet or by proxy, shall constitutetelephone.

Stockholder of Record; Shares Registered in Your Name.

If on April 24, 2017 your shares were registered directly in your name, then you are a quorum to conduct business.

Voting Rights

Broker discretionary voting (voting without specific instruction from the shareholder) has been eliminated in connection with uncontested electionstockholder of directorsrecord and corporate governance matters supported by management. As a result, broker discretionary voting will not be allowed with respect to any of the above proposals. Every shareholder is encouraged to participate in voting.

Methods of Voting

Shareholdersyou may vote in person at the Annual Meeting, vote by proxy over the Internet or by proxy. Shareholdersphone by following the instructions provided in the Notice or, if you request and received printed copies of recordthe proxy materials by mail, you may vote by mail, via telephone, via the internet or at the Meeting.mail. If you are a beneficial shareholder, please refer to your proxy card or the information forwarded to you by your bank, broker or other holder of record to identify which voting options are available to you. If you take advantage of telephone or Internet voting, you do not need to return your proxy card. Telephone and Internet voting facilities for shareholders of record will be available 24 hours a day, and will close at 3:00 AM Eastern Time on May 18, 2016.

A shareholder’s right to attend the meeting and vote in person will not in any way be affected by the method by which the shareholder has voted. The last vote of the shareholder is controlling. If shares are held in the name of a bank, broker or other holder of record, the shareholder must obtain a proxy,properly executed in their favor, from the holder of recordtime to be able to vote at the meeting. All shares that have been properly voted and not revoked will be voted at the meeting. When proxies are returned properly executed,Annual Meeting, the shares represented by the proxiesproxy will be voted in accordance with the directionsinstructions you provide. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person if you have already voted by proxy.

Beneficial Owners; Shares Registered in the Name of a Broker, Bank, or Other Nominee.

If on April 24, 2017 your shares were not registered in your name, but rather in the name of a broker, bank, or other nominee, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The broker, bank, or other nominee holding your shares is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial

owner, you have the right to direct your broker, bank, or other nominee regarding how to vote your shares. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker, bank, or other nominee.

Matters to be voted on at the Annual Meeting.

There are two matters scheduled for a vote:

•

Proposal 1: Election of five Directors to serve until the 2018 Annual Meeting of Stockholders; and

•

Proposal 2: Approval, on an advisory (non-binding) basis, of the shareholder. In those instances where proxy cards are signed and returned, but fail to specify the shareholder’s voting instructions, the shares represented bycompensation of our Named Executive Officers.

The Board knows of no other matters that proxy will be voted as recommendedpresented for consideration at the Annual Meeting. However, if any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their discretion.

How do I vote my shares?

You may vote your shares:

In Person: Attend the Annual Meeting and vote in person. If you are a beneficial owner be sure to obtain a valid proxy from your broker, bank, or other nominee.

By Mail: If you received our proxy materials by mail, simply complete, sign, and date the Boardaccompanying proxy card and return it promptly in the postage-paid envelope provided.

By Telephone: To vote over the telephone, call toll-free 1-800-652-VOTE (8683). Your telephone vote must be received by 3:00 a.m., Eastern Time, on June 9, 2017 to be counted.

By Internet: To vote through the Internet, go to www.investorvote.com/PAR or scan the QR code with your smartphone. Your Internet vote must be received by 3:00 a.m., Eastern Time, on June 9, 2017 to be counted.

Can I change my vote after submitting my proxy?

Yes, if you are a stockholder of Directors. Therecord, you can revoke your proxy solicited hereby may be revoked at any time prior to its exercisebefore the final vote at the Annual Meeting by: (i) executing and returning to the address set forth above

•

submitting a duly executed proxy bearing a later date; (ii) voting on

•

granting a later date viasubsequent proxy by telephone or through the Internet; (iii)

•

giving written notice of revocation to thePAR Technology Corporation’s Corporate Secretary of the Companyprior to or at the address set forth above;Annual Meeting; and

•

attending the Annual Meeting and voting in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy.

Your most current proxy card or (iv) votingtelephone or Internet proxy is the one that is counted.

If you are a beneficial owner of shares registered in the name of a broker, bank, or other nominee, you will need to follow the instructions provided by your broker, bank, or other nominee as to how you may revoke your proxy.

What constitutes a quorum?

The presence at the meeting.

Effects of Voting

With respect to the election of the Directors, shareholders may: (i) vote “FOR” the nominees namedAnnual Meeting, in this Proxy Statement;person or (ii) “WITHHOLD AUTHORITY” to vote for any or all such nominees. The election of the Directors requires a plurality of the votes cast. Accordingly, withholding authority to vote for any Director nominee will not prevent the nominee from being elected.

With respect to the non-binding advisory vote regarding the compensation of the Company’s Named Executive Officers, shareholders may: (i) vote “FOR”; (ii) vote “AGAINST”; or (iii) “ABSTAIN” from voting. For this proposal, the vote is advisory and not binding on the Company, its Board of Directors or the Compensation Committee in any way. Therefore, there is no vote required for approval. However, the Board of Directors and the Compensation Committee will take into account the outcome of the vote when making future decisions regarding the Company’s executive compensation programs.

With respect to any other matter that properly comes before the meeting, the affirmative voteby proxy, of the holders of a majority of the shares of Common Stock represented in person or by proxyour common stock outstanding on April 24, 2017 is necessary to constitute a quorum and to conduct business at the Annual Meeting.

What is an abstention and how will abstentions be treated?

An “abstention” represents a stockholder’s affirmative choice to decline to vote on a proposal. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares voting “abstain” will have no effect on any of the proposalproposals before the Annual Meeting.

What if I return a proxy card but do not make specific choices?

If you are a stockholder of record on April 24, 2017 and you return a properly executed, timely received and unrevoked proxy card without marking any voting selections, your shares will be required for approval.voted:

•

Electronic AccessProposal 1: “For” election of the five Director Nominees to Proxy Materialsserve until the 2018 Annual Meeting of Stockholders; and Annual Report

•

This Proxy Statement, FormProposal 2: “For” approval, on an advisory (non-binding) basis, of Proxythe compensation of our Named Executive Officers.

If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his discretion.

If you are a beneficial owner of shares registered in the name of a broker, bank, or other nominee, and you do not give instructions to your broker, bank or other nominee, then your broker, bank, or other nominee may not vote your shares and the Company’sshares will be treated as broker non-votes.

What are broker non-votes?

A broker non-votes occur when shares held by a broker, bank, or other nominee in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters without instructions from the beneficial owner of those shares.

None of the proposals to be considered at the Annual ReportMeeting are routine matters. Unless you provide voting instructions to its shareholdersthe broker, bank, or other nominee holding your shares, your broker, bank, or other nominee may not use discretionary authority to vote your shares on any of the proposals to be considered at the Annual Meeting. Broker non-votes will not be counted for purposes of determining whether a quorum is present.

Votes required and Board recommendations.

Proposal No. 1: Election of Directors

| Vote Required | | | Board Recommendations | |

| By a plurality of votes cast by shares present or represented either in person or by proxy and entitled to vote on the election of Directors, the five nominees for Director receiving the most “For” will be elected. Broker non-votes are not entitled to vote on this proposal and will not be counted in evaluating the results of the vote. Please vote your proxy or provide voting instructions to your broker, bank, or other nominee so your vote can be counted. | | | Board unanimously recommends a “For” all five Director nominees. | |

Proposal No. 2: On an Advisory (Non-Binding) Basis Approval of the Compensation of our Named Executive Officers.

| Vote Required (Non-Binding) | | | Board Recommendations | |

| The affirmative vote of a majority of votes cast by holders of shares present or represented either in person or by proxy and entitled to vote on this proposal is required to approve, on an advisory (non-binding) basis, the compensation of our Named Executive Officers. Broker non-votes are not entitled to vote on this proposal and will not be counted in evaluating the results of the vote. This advisory vote on executive compensation is non-binding on the Board. Please vote your proxy or provide voting instructions to your broker, bank, or other nominee so your vote can be counted. | | | Board unanimously recommends a vote “For” the approval of the compensation of our Named Executive Officers. | |

Who is paying for this proxy solicitation?

We will pay for the year ended December 31, 2015, including audited consolidated financial statements are available on the Company’s web site at https://www.partech.com/about-us/investors/annual-reports/.

Proxy Solicitation and Costs

entire cost of soliciting proxies. In addition to the use of the internetthese Proxy Materials, our Directors and mail service, directors, officers, employees and certain stockholders of the Company may also solicit proxies on behalf of the Company personally,in person, by telephone or by facsimile or electronic transmission. Noother means of communication. Directors and employees will not be paid any additional compensation will be paid to such individuals. The Company will bearfor soliciting proxies. We may also reimburse brokerage firms, banks, and other agents for the cost of the solicitation of proxies, including the preparation, assembly, printing and mailing of the Notice of Internet Availability, this Proxy Statement and any additional information furnished to shareholders. The Company will also bear the cost of the charges and expenses of brokerage firms and others forwarding the solicitation materialproxy materials to beneficial owners of shares of the Company’s Common Stock. The internet and telephone voting procedures are designed to verify a shareholder’s identity, allows the shareholder to give voting instructions and confirm that such instructions have been recorded properly.owners.

Proposal 1: Election of Directors

PROPOSAL 1 — ELECTION OF DIRECTORS

Pursuant to the Company’s Certificateour amended certificate of Incorporation, as amended in 2014,incorporation, all directors (other than those who may be elected by the holders of any series of preferred stock, voting as a separate class)Directors are elected for a one-year term expiring at the next annual meeting of shareholders. Each director shallstockholders.

At this Annual Meeting, five Directors are to be elected and, if elected, each Director will serve until the 2018 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified or, earlier, until his or her death, resignation, or removal. Therefore, at this meeting, directors will be elected for a one-year term expiring at the Annual Meeting held in 2017. The sevenAll Director nominees of the Board of Directors are all currently members of the Board and have been nominated for electionre-election by the Board upon the recommendation of the Nominating and Corporate Governance Committee and each has consented to stand for re-election.

Committee. The Board has no reason to believe that any of the Director nominees will beare unable or unwilling to serve, if elected. In the event that any of the nominees shall become unable or unwillingand each Director nominee has consented to accept nomination or election as a director, it is intended that such shares will be voted, by the persons named in the Form ofthis Proxy for the election of a substitute nominee selected by the Board, unless the Board should determineStatement and to reduce the number of directors pursuant to the By-Laws of the Company.

serve if elected.

The names offollowing table sets forth information about the nominees, their agesCompany’s Directors, as of April 8, 2016,24, 2017, which are the year each first became a director are set forth inDirector nominees:

| Director | | | Age | | | Director Since | | | Positions and Offices | | | Independent(1) | |

| Paul D. Eurek | | | 57 | | | 2014 | | | | | | Yes | |

| Dr. Donald H. Foley | | | 72 | | | 2016 | | | Chief Executive Officer and President of PAR

President of ParTech, Inc. | | | No | |

| Cynthia A. Russo | | | 47 | | | 2015 | | | | | | Yes | |

| Dr. John W. Sammon | | | 78 | | | 1968 | | | | | | No | |

| Todd E. Tyler | | | 54 | | | 2014 | | | | | | Yes | |

(1)

Independent under the following table.listing standards of the New York Stock Exchange and our Corporate Governance Guidelines.

| | Nominees for Director | Age | Director Since |

| | Ronald J. Casciano | 62 | 2013 |

| | Paul D. Eurek | 56 | 2014 |

| | Dr. Donald H. Foley | 71 | 2016 |

| | Cynthia A. Russo | 46 | 2015 |

| | Dr. John W. Sammon | 77 | 1968 |

| | Karen E. Sammon | 51 | 2016 |

| | Todd E. Tyler | 53 | 2014 |

The Board of Directors unanimously recommends a vote FOR“For” the proposal to elect allelection of each of the above namedDirector nominees for a one year term to the Company’s Board. .Unless a contrary direction is indicated, shares represented by valid proxies and not so marked as to withhold authority to vote for the nominees will be voted FOR the election of the nominees.

DIRECTORS

AND EXECUTIVE OFFICERS

AND CORPORATE GOVERNANCE

DIRECTORS

DIRECTOR NOMINEES

Directors and Director Nominees

Below are summaries of the background, business experience and description of the principal occupation of each of the nominees.

Ronald J. Casciano. Mr. Casciano was appointed Director in March 2013 coincident with his appointment to the position of Chief Executive Officer and President of PAR Technology Corporation in which he served until his retirement effective January 1, 2016. Mr. Casciano also served as Treasurer of the Company from 1995 until January 1, 2016. Mr. Casciano also serves as a director on the boards of the Company’s subsidiary companies within the Government business segment. Joining the Company in 1983, Mr. Casciano, a Certified Public Accountant, held several leadership positions with the Company including Chief Accounting Officer (2009-2012), Vice President, Chief Financial Officer (1995 to 2012), and Senior Vice President, Chief Financial Officer (2012 until March 2013). In addition to his experience as CEO and President of the Company, Mr. Casciano brings to the Board his broad based functional management experience, including accounting, finance, investor relations, information technology, human resources, and facilities. Mr. Casciano formerly served as a member of the Board of Directors and Chair of the Audit Committee of Veramark Technologies, Inc., a position he held from 2011 until the sale of that company in 2013.

Paul D. Eurek.Eurek. Mr. Eurek is the President of Xpanxion LLC (UST Global Group), serving in that capacity since 1998 when he founded the company. Privately held, Xpanxion is a professional services and software development company focused on cloud centric technology headquartered in Atlanta, Georgia. Mr. Eurek is also the co-founder and founding Chief Executive Officer of Hi Tech Partners Group, a start-up incubator and investment company, also founded in 1998. Since 2013, Mr. Eurek has served as a member of the board of directorsDirectors and is presently Chairman of the Board of Invest Nebraska Corporation, a 501(c)(3) corporation which operates as an investment and funding vehicle for the State of Nebraska and other organizations. Mr. Eurek previously served as the President and Chief Executive Officer of Compris Technologies, Inc. which he founded in 1992 and by 1997 grew to a global provider of retail enterprise systems when it was acquired by NCR Corporation. Mr. Eurek contributes his deep understanding of global hospitality technology, cloud based systems and implementation experience, executive and organizational management proficiencies and knowledge of strategic planning. Mr. Eurek serves as the Chairis a member of the Audit Committee, Compensation Committee serves on the Audit(Chair) and Nominating/Nominating and Corporate Governance Committees and has been a Director since July 22, 2014.

Committee of our Board of Directors.

Dr. Donald H. Foley. Foley. Prior to his appointment as PAR’s Chief Executive Officer and President, Dr. Foley served as a member of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee of PAR’s Board of Directors. Dr. Foley has more than 35 years of

technology based government contracting and organizational management experience, risk management, and strategic planning, in both the private and public sectors. Dr. Foley is the founder and sole proprietor of Martingale Consulting, an executive level and strategic, managerial and business development services firm. Priorfirm, which Dr. Foley founded in 2011. From 1991 to establishing Martingale Consulting,2011, Dr. Foley held various senior executive positions at Science Applications International Corporation (“SAIC”, currently Leidos Holdings, Inc.), one of the nation’s largest government contractors, providing scientific, engineering, systems integration and technical services and solutions to all branches of the U.S. Military, agencies of the U.S. Department of Defense, the Intelligence Community, the U.S. Department of Homeland Security and other U.S. Government civil agencies, as well as to customers in selected commercial markets. At SAIC, Dr. Foley served as theExecutive Vice President from 2005 to 2011, as Group President of the Research and Intelligence Group of Science Applications International Corporation (“SAIC” now known as Leidos, Inc.) from 1991 to 2005, and Executive Vice President, from 2005 to 2011. Dr. Foley also served as a member of the Board of Directors of SAIC from 2002 to 2007. Leidos, one of the nation’s largest government contractors, provides scientific, engineering, systems integration and technical services to the United States Department of Defense and governmental intelligence agencies as well as selected commercial markets.Since 2011, Dr. Foley has been a memberserved on the boards of directors of two private companies, Thomas Somerville Co. and T.S. Realty Co., and on the Board since January 1, 2016board of directors of Government Secure Solutions CGI (GSSC), Inc., an indirect, non-public subsidiary, of CGI Group Inc., whose securities are registered on the NYSE and is a member of the Audit, Compensation and Nominating/Corporate Governance Committees. Dr. Foley brings to the Board a broad range of technology based government contracting and organizational management experience, risk management and strategic planning.

Toronto Stock Exchange.

Cynthia A. Russo.Russo. Ms. Russo is the Executive Vice President and Chief Financial Officer of Cvent, Inc., a position she has held since September 28, 2015. Cvent is a cloud-based enterprise event management platform provider offering solutions to event planners for online event registration, venue selection, event management, mobile applications, email marketing and web surveys. From April 2010 until December 2014, Ms. Russo served as Executive Vice President and Chief Financial Officer of MICROS Systems, Inc., a provider of integrated software, hardware and services solutions to the hospitality and retail industries. Ms. Russo joined MICROS in 1996 and, prior to her promotion in April 2010, served in various other financial roles. On September 8, 2014, MICROS became an indirect, wholly-owned subsidiary of Oracle Corporation. Ms. Russo is a member of the Board since her election on May 28, 2015, serves as the Lead Director of the Board, Presiding Director of the independent directors, Chair of the Audit Committee and also serves as a member of the Compensation and Nominating/Corporate Governance Committees. A Certified Public Accountant and Certified Internal Auditor, Ms. Russo qualifies as a financial expert within the meaning of the rules of the Securities and Exchange Commission.Auditor. Ms. Russo brings financial acumen, risk management and organizational management proficiencies.

Ms. Russo is a member of the Audit Committee (Chair), Compensation Committee and Nominating and Corporate Governance Committee of our Board of Directors, and serves as the presiding Director at executive sessions of the independent Directors.

Dr. John W. Sammon. Dr. Sammon is the founder of the Company and served as the Company’s Chief Executive Officer, President, and Chairman of the Board until he retired from his management role in the Company and stepped down as Chairman of the Board in April 2011. Dr. Sammon also serves as a director on the boards of the Company’s subsidiary companies within theour subsidiaries PAR Government business segment.Systems Corporation and Rome Research Corporation. The extensive experience gained as leader of the Company since its inception, as well as from the various senior executive capacities he has held with the Company’s subsidiaries, gives Dr. Sammon an in depth understanding of the Company’s business and its customers. Dr. Sammon also brings to the Board his extensive leadership experience, strategic planning and broad organizational development expertise. In April 2011, Dr. Sammon was named Chairman Emeritus of the Board. Dr. Sammon has been a Director of the Company since 1968. Dr. Sammon is the father of Karen E. Sammon, a Director and an Executive OfficerChief of the Company serving as President and Chief Executive OfficerStaff of the Company and John W. Sammon, III, who serves as Vice President and General Manager of the SureCheck®SureCheck business within the Company’s restaurant and retail business unit,segment, operated through the Company’s wholly-owned subsidiary ParTech, Inc.

Karen E. Sammon. Ms. Sammon is the President and Chief Executive Officer of the Company. Prior to her promotion on January 1, 2016, Ms. Sammon served as the President of the Company’s restaurant and retail business unit, ParTech, Inc., a position held since April 2013. Ms. Sammon also currently holds executive and director positions with subsidiaries of the Company. Ms. Sammon is the former Senior Vice President of The CBORD Group, Inc. (“CBORD”) which she joined in 2010. CBORD is a provider of cashless card solutions, food and nutrition service management software, and integrated security solutions for colleges and universities, healthcare facilities, supermarkets, and corporations. While at CBORD, Ms. Sammon had responsibility for strategic planning and management of CBORD’s US and Asia/Pacific operations. Prior to joining CBORD, Ms. Sammon held a variety of positions with ParTech, Inc. from 1993 to 2010, including Chief Product & Strategy Officer; President, PAR Software Solutions; Vice President, Business Development, Director of Marketing and Corporate Counsel. Ms. Sammon has been a member of the Board since January 1, 2016 and brings to the Board the benefit of her extensive global hospitality technology experience, organizational development, strategic planning, change management, and diverse functional leadership experience. Ms. Sammon is the daughter of Dr. John W. Sammon, Director, Chairman Emeritus and Founder of the Company.

Todd E. Tyler.Tyler In December, 2015,. Mr. Tyler becameis the CEOChief Executive Officer, President and member of the Board of Directors of Electronic Commerce,Vibe HCM, Inc., a cloud based softwareSaaS company which providesproviding human capital management solutions. Mr. Tyler also sits on the boards of numerous cloud based private softwareSaaS companies and serves in an advisory capacity to certain private equity firms. From April 2001 to October 2013, Mr. Tyler was the Chief Executive Officer, President CEO and member of the Board of Directors of Lanyon, Inc. which provides cloud-based softwareprovided enterprise SaaS solutions for the meeting and events industry and transient hotel programs. In December 2012, Lanyon was acquired by Vista Equity Partners in December 2012.and was subsequently merged into Cvent. Prior to joining Lanyon, Mr. Tyler served as the Chief Financial Officer, General Counsel and member of the Board of Directors of a wholly owned subsidiary of CenterPoint Energy (formerly known as Reliant Energy, Inc.) from April 2000 to March 2001. Mr. Tyler is an attorney and a member in good standing of the State Bar of Texas and is also a financial expert within the meaning of the rules of the Securities and Exchange Commission.Texas. Mr. Tyler brings to the Board his financial reporting and risk management proficiencies, global hospitality technology experience, as well as a solid background in strategic planning and executive and organizational development. Mr. Tyler serves as the Chair of the Nominating/Corporate Governance Committee and asis a member of the Audit Committee, Compensation Committee and Compensation Committees. Mr. Tyler has been a Director since July 28, 2014.Nominating and Corporate Governance Committee (Chair) of our Board of Directors.

EXECUTIVE OFFICERS

The following tables list all persons who served astable sets forth information about our executive officers of the Company during all or part of 2015, and all persons serving as executive officers in 2016, their respective ages as of April 8, 2016, positions held by such persons and occupations for the last five years. All of the current executive officers of the Company are serving open ended terms. There is no arrangement or understanding between any executive officer and any other person pursuant to which the executive officer was selected.

24, 2017.

| Name | Name | | Age | | | Positions heldand Offices | |

| Dr. Donald H. Foley | Matthew R. Cicchinelli (1)

| 53 | ·President, PAR Government Systems Corporation and Rome Research Corporation

·Vice President, ISR Innovations, PAR Government Systems Corporation

|

| 72 | Viola A. Murdock (2)

| 60 | ·Vice President, General Counsel & Secretary, PAR Technology Corporation

|

| Karen E. Sammon (3)

| 51 | ·President and Chief Executive Officer, PAR Technology Corporation

·President, ParTech, Inc.

|

| Matthew J. Trinkaus (4)

| 33 | ·Corporate Controller, Chief Accounting Officer and Acting Treasurer, PAR Technology Corporation

|

(1) | Mr. Cicchinelli was named President, PAR Government Systems Corporation and Rome Research Corporation effective December 15, 2015. Mr. Cicchinelli, joined PAR in 2011 as Executive Director for Operations, and in 2013 was promoted to Vice President, Intelligence, Surveillance and Reconnaissance (“ISR”) Innovations. Prior to joining PAR, Mr. Cicchinelli served in various senior roles with the United States Marine Corps and the Department of Defense with a focus on command and control, ISR technologies, and strategic plans and policies. Mr. Cicchinelli retired from the Marine Corps in 2011 with the rank of Colonel. |

(2) | Ms. Murdock was named Vice President, General Counsel & Secretary of the Company effective September 17, 2014. Prior to her promotion Ms. Murdock served as Senior Corporate Counsel since 1996 and Acting Secretary since 2013. Ms. Murdock has advised the Company of her intent to retire from the Company in 2016. |

(3) | Ms. Sammon was named President and Chief Executive Officer of the Company effective January 1, 2016. Ms. Sammon served as President, ParTech, Inc. from April 2013 until the time of her promotion. |

(4) | Mr. Trinkaus was named Chief Accounting Officer effective March 31, 2015 and Acting Treasurer effective January 1, 2016. A Certified Public Accountant, Mr. Trinkaus holds this position concurrent with the position of Corporate Controller which he has held since January 1, 2015. Mr. Trinkaus joined the Company in January of 2013, as Assistant Corporate Controller. Before joining the Company, Mr. Trinkaus served as Vice President, Assistant Corporate Controller with NBT Bancorp, beginning in November 2011. From April 2010 to November 2011, Mr. Trinkaus worked as a Senior Audit Associate with KPMG LLP. |

The following lists those Executive Officers who served in that capacity during all or any part of 2015 but have separated from the Company prior to April 8, 2016.

| Name | Age | | Positions |

| Michael S. Bartusek (1)

| 47 | | Vice President, Chief Financial Officer |

| Ronald J. Casciano (2)

| 62 | | Chief Executive Officer, President, and Treasurer, PAR Technology CorporationDirector of the Company and President of ParTech, Inc. | |

| Bryan A. Menar | Lawrence W. Hall (3)

| 56 | 42 | | | Chief Financial Officer and Vice President PAR Springer-Miller Systems, Inc.of the Company | |

| Matthew R. Cicchinelli | Robert P. Jerabeck(4)

| 60 | 54 | Vice President and Chief Operations Officer |

| | Stephen P. Lynch (5)

| 59 | | President, PAR Government Systems Corporation and

President of Rome Research Corporation |

| Steven M. Malone (6)

| 35 | | Vice President, Corporate Controller and Chief Accounting Officer, PAR Technology Corporation |

Donald H. Foley. Biographical information with regard to Dr. Foley is presented under “DIRECTORS AND EXECUTIVE OFFICERS — DIRECTORS — Directors and Director Nominees.”

(1) | Mr. Bartusek was terminated from the Company for cause effective March 14, 2016 in connection with unauthorized investments made in contravention of the Company’s policies and procedures involving Company funds. Mr. Bartusek served as Vice President and Chief Financial Officer of the Company from July 20, 2015 until his termination. Prior to joining the Company, Mr. Bartusek served as the Chief Financial Officer and Corporate Treasurer at Sutherland Global Services, Inc. (“SGS”) a $900M business process outsourcer, from 2007 to October 2014. Prior to SGS, Mr. Bartusek was Director of Finance for the North American operations at XEROX Global Services, Inc. from 2004 to 2007. |

On April 12, 2017, we entered into an employment offer letter with Dr. Foley in connection with his appointment as Chief Executive Officer and President of PAR. Pursuant to that agreement, Dr. Foley will receive an annual base salary of $460,000, 25% of which will be paid in time vesting restricted stock, that vest ratably monthly; such shares will be granted on the first day of the open trading window following April 12, 2017, the effective date of Dr. Foley’s employment. Dr. Foley will participate in our annual incentive compensation plan, starting in the 2017 calendar year, at a rate of 75% of his annual base salary for on plan performance against financial targets associated with our 2017 annual operating plan and specific business objectives established by the Board; 25% of Dr. Foley’s incentive compensation bonus, will be paid in shares of time vesting restricted stock. If Dr. Foley’s employment is terminated without cause in 2017, he will be paid the balance of his 2017 base salary. Additionally, if Dr. Foley’s employment is terminated without cause on or after August 1, 2017 or if he is employed as of December 31, 2017, Dr. Foley will be paid not less than 50% of his pro-rated short-term incentive bonus.

Bryan A. Menar. Mr. Menar joined the Company as Chief Financial Officer and Vice President on January 3, 2017. From January 2015 to January 2017, Mr. Menar served as Vice President, Financial Planning and Analysis of Chobani, LLC, a producer of Greek Yogurt products based in Central New York. In this role, Mr. Menar was responsible for corporate financial analysis, including forecasting, budgeting, business reviews and financial presentations for both internal and external stakeholders and partners. From October 2012 to December 2014, Mr. Menar served as Director of Financial Planning and Analysis for Chobani. In addition, Mr. Menar served as a consultant with J.C. Jones & Associates, a national business consulting firm, from 2010 to 2012, and as Vice President, Merchant Bank Controllers, of Goldman Sachs & Co. from 2002 – 2010. Mr. Menar is a Certified Public Accountant.

(2) | Mr. Casciano retired from the position of Chief Executive Officer and President of the Company effective January 1, 2016 but continues in the capacity of Director for the Company and subsidiary companies within the Government Business segment. A more detailed biography for Mr. Casciano can be found above in connection with Director Nominees. |

In connection with his appointment as Chief Financial Officer and Vice President, Mr. Menar entered into an employment agreement, which provides that his employment is “at will”, and provides the following compensation components: (1) an annual base salary of $250,000; (2) participation in our short-term incentive compensation, at an individual bonus target of up to 30% of his annual base salary for fiscal 2017 performance; (3) subject to approval and terms established by the Board, grants under the PAR Technology Corporation 2015 Equity Incentive Plan of non-qualified stock options for 40,000 shares of common stock, that vest ratably over four years on the anniversary of the date of grant; and (4) participation in our retirement plan, as well as the provision of insurance benefits and other customary benefits offered by us to our senior executives. Mr. Menar was also paid a $50,000 signing bonus. Any termination of Mr. Menar’s employment without cause prior to November 14, 2019, will result in a severance payment of an amount equal to six months of his then annual base salary in exchange for a duly executed standard release.

Matthew R. Cicchinelli. Mr. Cicchinelli was named President of PAR Government Systems Corporation and Rome Research Corporation effective December 12, 2015. Mr. Cicchinelli, joined PAR in 2011 as Executive Director for Operations, and in 2013 was promoted to Vice President, Intelligence, Surveillance and Reconnaissance (“ISR”) Innovations. Prior to joining PAR, Mr. Cicchinelli served in various senior roles with the United States Marine Corps and the Department of Defense with a focus on command and control, ISR technologies, and strategic plans and policies. Mr. Cicchinelli retired from the Marine Corps in 2011 with the rank of Colonel.

(3) | Mr. Hall separated from the Company in November 2015 in connection with the Company’s divestiture of the hotel and spa technology business unit. Mr. Hall had served as President, PAR Springer-Miller Systems, Inc., a wholly owned subsidiary of the Company and part of the Company’s Hospitality business segment since August 2008. |

(4) | Mr. Jerabeck separated from the Company on April 15, 2015 when the Company eliminated the position of Chief Operating Officer. Mr. Jerabeck had served as Executive Vice President and Chief Operating Officer of the Company since April 2013. Prior to joining the Company, Mr. Jerabeck, held various positions with a unit of Honeywell International Inc., Honeywell Scanning and Mobility, a global supplier of data collection and management solutions for in-premises, mobile and wireless applications. From March 2012 until joining the Company, Mr. Jerabeck served as Director, Quality Assurance, and, from May 2011 through September 2012, he led the integration of the EMS Global Tracking and LXE businesses acquired by Honeywell Scanning and Mobility. |

(5) | Mr. Lynch separated from the Company on September 1, 2015. Mr. Lynch had served as President of two of the Company’s wholly owned subsidiaries in the Company’s Government business segment, PAR Government Systems Corporation and Rome Research Corporation since January 2008. |

(6) | Mr. Malone separated from the Company on March 31, 2015 to pursue another opportunity. Mr. Malone, a Certified Public Accountant, was named Vice President and Chief Accounting Officer of the Company in May 2012.Mr. Malone held these positions concurrently with the position of Controller, ParTech, Inc. a position he held since August 2014 and Corporate Controller, a position he held from June 2010 through December 31, 2014. Mr. Malone joined the Company in May 2009 as the Director of Financial Analysis and Planning. |

CORPORATE GOVERNANCE

As providedDirector Independence. Each of our Directors, other than Dr. Sammon and Dr. Foley, has been determined by the By-Laws of the Company, as amended, and the laws of the State of Delaware, the Company’s state of incorporation, the business of the Company is under the general direction of the Board. The Board is comprised of six non-management directors and one management director.

Director Independence. The Board of Directors has affirmatively determined that four of the non-management directors (Directors Eurek, Foley, Russo and Tyler) areto be “independent” under the listing standards of the New York Stock Exchange (“NYSE”), the Company’s Standards of Independence, and pursuant to the Company’s Corporate Governance Guidelines. Prior to his departure from the Board in May 2015, former Director John S. Barsanti was affirmatively determinedas supplemented by the Board to also meet these independence standards. In order to assist the Board in making this determination, the Board has adopted standards of independence as part of the Company’sour Corporate Governance Guidelines, which are available onsubstantially similar to and consistent with the Company’s website at https://www.partech.com/wp-content/uploads/2015/12/PAR_Corp_Gov_Guidelines-as-Amended-12-10-14.pdf. Thelisting standards inof the NYSE, including considerations of material business and familial relationships, previous employment considerations and auditor affiliations. Our Corporate Governance Guidelines identify, amongare posted in the “SEC Filings” section of our website at www.partech.com/about-us/investors. Our independent Directors are identified as “Independent” in the table on page 5 of this Proxy Statement.

In its determination that Mr. Eurek is independent, the Board considered Xpanxion LLC’s provision of software development services to Partech, Inc., a direct wholly owned subsidiary of PAR, pursuant to a statement of work entered into in October 2016, and confirmed Mr. Eurek’s independence under the listing standards of the NYSE, our Corporate Governance Guidelines, and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Among the factors considered by the Board in concluding Mr. Eurek’s independence were the immateriality of the arrangement to Mr. Eurek, the type of services being provided - software development services, payments are made to Xpanxion and such payments will not exceed the greater of $1,000,000 or 2% of Xpanxion’s consolidated gross revenues in any fiscal year while Mr. Eurek serves as President of Xpanxion and a Director of PAR, and Mr. Eurek receives no additional payment or other things, material business, charitable and other relationships that could interfere with a director’s ability to exercise independent judgment. During 2015, there were no transactions, relationships or arrangements between the Company and Directors Eurek, Russo or Tyler or any of their respective immediate family members or entities with which they are affiliated. Dr. Foley, through his consulting firm, Martingale Consulting, servedincremental remuneration from Xpansion as a consultant to the Company from April 25, 2012 through December 8, 2015. In no twelve month period during the last three years did Dr. Foley receive compensation from the Company that totaled or exceeded $120,000. During 2015, Dr. Foley received compensation in connection with this consulting relationship totaling $80,000. This consulting relationship with Martingale Consulting ceased in December 2015 and, during 2015, there were no other transactions, relationships or arrangements between the Company and Director Foley or any of his immediate family members or entities with which his is affiliated. During 2015, there were no transactions, relationships or arrangements between the Company and former Director Barsanti or any of his immediate family members or entities with which his is affiliated. There are no family relationships between Directors Eurek, Foley, Russo or Tyler and anyresult of the Company’s executive officers (“Executive Officers”). The Executive Officers servesoftware development services provided to ParTech, Inc. Further, Mr. Eurek’s successor at Xpanxion was named and announced in January 2017, and Mr. Eurek has informed the discretion of the Board.

Board that he will fully retire from Xpanxion on June 30, 2017.

Board Meetings and Attendance.Attendance In 2015,. During the 12-month period ended December 31, 2016 (“fiscal 2016”), the Board held 20eight meetings and the standing Committees of the Board held a total of 13 meetings.took action by unanimous written consent nine times. Each directorDirector attended at least 75% or more of the aggregate number of all meetings of the Board and of the committees on which they served.he or she served, held during the portion of fiscal 2016 for which he or she was a Director or committee member. It is the Company’s policy to encourage directors to attend the Annual Meetingannual meetings of Shareholdersstockholders but such attendance is not required. Last year, one member ofTwo Board members attended the Board attended thefiscal 2016 Annual Meeting of Shareholders.

Board Leadership Structure. StructureSince 2013, the Company’s By-Laws provide for the separation of the position of Chairman of the. The Board from the office of Chief Executive Officer. In 2015, former Director Barsanti served as Chairman of the Board and Presiding Director of the independents until the expiration of his term on May 28, 2015. Following the 2015 Annual Meeting of Shareholders, the Board diddoes not electhave a Chairman, of the Board but placed the leadership of the Board with Directorrather, Cynthia Russo, who was electedserves as independent Lead Director, and who performs the function of the Chairman of the Board. The Board has determined that the separation of the roles of Lead Director and Chief Executive Officer is appropriate, for the Company as it enables theour Chief Executive Officer to focus more closely on the day to dayday-to-day operations of the CompanyPAR while the Lead Director provides leadership to the Board. As a result, theThe Board believes a non-executivean independent Lead Director enablesis better situated to represent the leaderinterests of the Company’s BoardPAR stockholders and to better represent shareholder interests and provide independent evaluation of and oversight over management. The Board also believes that suchthe separation between the offices and functions of Chief Executive Officer and Lead Director is consistent with best practices of corporate governance of a publicly traded company. The independent directors have also designated Director Russo as the independent lead or Presiding Director with broad authority and responsibility. During 2015, Presiding Director Barsanti scheduled and presided at one executive session of the non-management directors and one executive session of the independent Directors without any management directors or employees present. Presiding Director Russo scheduled and presided over one executive session of the independent Directors without any management directors or employees present. The respective Presiding Directors communicated with the Chief Executive Officer to provide feedback and recommendations of the independent directors.

practices.

Board Oversight of Risk Management.Management. The Board is responsible fordoes not have a separate risk management committee, but rather the full Board manages the risk oversight function, with certain areas addressed by committees of risk management. As part of its meetings in 2015, the Board, dedicated timewhere such risks are inherent in the committee’s respective area of oversight. In particular, the Audit Committee oversees our risk guidelines, policies and processes established by management relating to reviewour financial statements and discuss with management specific risk topics in detail. In addition, the Board held four meetings in 2015 for a comprehensive review with management of each of the Company’s business segments to discuss existing and potential strategic and operational risks. Follow up with the Board was conducted as appropriate.financial reporting processes. The Audit Committee oversees the Company’s risk policiesinternal audit function, and processes relating to themeets regularly with management and our independent public accounting firm concerning our financial statements and financial reporting processes, including our internal controlscontrol over financial reporting. The Company’s Internal Audit function reports directly to the Audit Committee and the Committee meets regularly with the Company’s management and independent public accounting firm regarding these mattersreporting and the effectiveness of such controls and processes. TheOur Audit Committee regularly reports on such matters toperiodically meets with senior management and the full Board.

Board to monitor and assess our strategies and risk exposure, including the nature and level of risk appropriate for PAR. The full Board also meets regularly with and receives periodic reports from our legal, compliance and operations groups regarding legal and regulatory requirements and operational considerations.

Committees. CommitteesThe. Our Board has three standing committees: Audit; Compensation;committees — Audit Committee, Compensation Committee, and Nominating/Nominating and Corporate Governance. Pursuant toGovernance Committee — each Board committee operates under a written charter that has been approved by the Company’s By-Laws,Board. Current copies of each committee’s charter are posted in the Board may designate members“SEC Filings” section of our website at www.partech.com/about-us/investors.

The following table provides information about membership (including independence) and committee meetings in fiscal 2016 for each of the Board to constitute such other committees ascommittees:

| Name | | | Audit(1) | | | Compensation(2) | | | Nominating and

Corporate Governance(3) | |

| Paul D. Eurek(4) | | | X | | | X (Chair) | | | X | |

| Donald H. Foley(5) | | | X | | | X | | | X | |

| Todd Tyler | | | X | | | X | | | X (Chair) | |

| Cynthia A. Russo | | | X (Chair) | | | X | | | X | |

| Total meetings in fiscal 2016 | | | 17 | | | 3 | | | 1 | |

(1)

Independent under the Board may determine to be appropriate. The members of each of the three standing committees and the number of meetings held by each committee in 2015 are set forth in the following table.

| | Name | Audit | Compensation | Nominating & Corporate Governance |

| | Meetings Held in 2015 | 4 | 6 | 3 |

| | Members | | | |

| | Paul D. Eurek | X | Chair | X |

| | Dr. Donald H. Foley (1) | X | X | X |

| | Cynthia A. Russo (2) | Chair | X | X |

| | Todd E. Tyler | X | X | Chair |

| (1) | The effective dates of Director Foley’s committee assignments coincide with the date of his appointment to the Board effective January 1, 2016. |

| (2) | The effective dates of Director Russo’s committee assignments coincide with the date of her election to the Board on May 28, 2015. Prior to May 28, 2015, the committee assignments currently held by Director Russo were held by former Director John S. Barsanti. |

Audit Committee. In accordance with its charter, the Audit Committee assists the Board in oversight of the Company’s accounting and financial reporting processes, systems of internal control, the audit process of the Company’s financial statements, and the Company’s processes for monitoring compliance with applicable laws and regulations as well as the Company’s code of ethics and conduct. The New York Stock Exchange (“NYSE”) and the Committee’s charter require the Audit Committee to consist of a minimum of three members, each of whom has been determined by the Board to meet the independencelisting standards adopted by the Board. The standards adopted by the Board incorporate the independence requirements of the NYSE, Rule 10A-3 of the Exchange Act, and as defined in the Audit Committee’s charter.

(2), (3)

Independent under the listing standards of the NYSE and as defined in the Compensation Committee’s charter and the Nominating and Corporate Governance Standards and the independence requirements set forth by the SEC. The Board has determined each of the members of the Audit Committee (including any member who has stepped down during 2015) and the current members of the Audit Committee to be “independent”Committee’s charter.

(4)

Mr. Eurek served as this term is defined by the NYSE in its listing standards, meet SEC standards for independence of audit committee members and noa member of the Audit Committee has a material relationship with the Company that would render that member not to be “independent”. The NYSE and the Committee’s charter require all members of the Committee to be financially literate at the time of their appointmentuntil July 2016; he was reappointed to the Audit Committee or withinon April 21, 2017.

(5)

Dr. Foley resigned as a reasonable time thereafter. The Board has determined that all membersmember of the Audit Committee, are financially literateCompensation Committee and the ChairNominating and Corporate Governance Committee effective on his appointment as Chief Executive Officer and President of the Committee, Director Russo, and Director Tyler are each an “audit committee financial expert”, as defined by the SEC. The number of meetings of the Audit Committee indicated in the table above includes meetings held separately with management, the Company’s Internal Audit function, the independent public accounting firm, as well as separate executive sessions with only independent directors present. The Report of the Audit Committee begins on page 11 of this Proxy Statement.PAR.

Compensation Committee. Committee. The Committee’s charter requires the Compensation Committee to be comprised of a minimum of three independent directors.oversees and administers our executive compensation program. The present Committee is comprised of four members. The Board has determined that each ofCompensation Committee’s responsibilities include:

•

Reviewing and approving the members of the Committee has met the independence standards adopted by the Board which incorporate the independence requirements of NYSE listing standards even though these rules are not applicable to smaller reporting companies. Meeting as needed, the Compensation Committee reviews and approves corporate goals and objectives relevant to the compensation of the Company’sour Chief Executive Officer, evaluates performance in light of those goalsOfficer’s compensation and, objectiveseither as a Committee or with the other independent directors, determine and determines and approves the compensation level (including any long-term compensation components) and benefits based on this evaluation. In addition, the recommendations of theapprove our Chief Executive Officer regarding the compensation, benefits, stock grants, stock options and incentive plans for all Executive Officers of the Company are subject to the review and approval of the Compensation Committee. The Compensation Committee also reviews and makesOfficer’s compensation;

•

Reviewing, making recommendations to the Board, regardingand overseeing the leveladministration of our incentive compensation arrangements;

•

Reviewing and formapproving compensation of our executive officers; and

•

Reviewing and recommending to the Board the compensation for our non-employee directors in connection with service on the Board and its committees.directors.

In 2015 the Committee did not engage any independent compensation consultant, choosing to utilize purchased survey data more fully described in the compensation discussion under the heading Executive Compensation commencing on page 17 of this document.

Nominating/Corporate Governance Committee. Pursuant to the NYSE listing standards all members of the Nominating/Nominating and Corporate Governance Committee are independent. Pursuant to its charter a minimum of three independent directors must constitute the Nominating/Corporate Governance Committee. The present Committee is comprised of four members. The Board has determined that each of the members of the Nominating/Corporate Governance Committee has met the independence standards adopted by the Board which incorporate the independence requirements of NYSE listing standards.. The Nominating and Corporate Governance Committee assists the Board in meeting its responsibilities to:by:

•

| · | identify and recommend qualified nominees for election to the Board |

identifying and recommending qualified nominees for election to the Board; | · | develop and recommend to the Board a set of corporate governance principles, as set forth in the Company’s Corporate Governance Guidelines; |

| · | maintain the corporate code of ethics and conduct as set forth in the Company’s Code of Business Conduct and Ethics; and |

| · | monitor the compliance with, and periodically review and make recommendations to the Board regarding the Company’s governance. |

•

Committee Charters. The Board of Directors has approved the charters under which the Audit, Compensation,developing and Nominating/Corporate Governance Committees operate. These charters are reviewed regularly by the respective committees, which may recommend appropriate changes for approval by the Board. Copies of the charters for the Audit, Compensation, and Nominating/Corporate Governance Committees are posted on the Company’s website and a printed copy of these documents may be obtained without charge by written request. Requests can be made via the internet or by mail. The respective website and address for making such requests for printed copies of these and other available documents may be found under the heading “Available Information” on page 29 of this Proxy Statement.

Presiding Director and Executive Sessions. The independent directors have chosen Director Russo to preside at regularly scheduled executive sessions of the independent directors during 2015 and during 2016 until the Annual Meeting. Prior to expiration of his term on May 28, 2015, this role was filled by former Director John S. Barsanti. Among their duties and responsibilities in this capacity, the respective Presiding Directors chaired and had the authority to call and schedule Executive Sessions of the non-management directors and the independent directors. The Presiding Director communicated with the Chief Executive Officer and the Board to provide feedback and recommendations of the independent directors. The independent directors met in executive session with only independent directors being present a total of two times during 2015.

Communication with the Board. The Board avails itself to communications from the Company’s shareholders. Interested parties may send written communicationrecommending to the Board as a group, the independent directors as a group, the Presiding Director, or to any individual director by sending the communication c/oset of corporate governance principles — our Corporate Secretary, PAR Technology Corporation, PAR Technology Park, 8383 Seneca Turnpike, New Hartford, NY 13413. Upon receipt, the communication will be relayed to Director Russo if it is addressed to the Board as a whole, to the Presiding Director, or to the independent directors as a group. If the communication is addressed to an individual director, the communication will be relayed to the individual director. All communications regarding financial accounting, internal controls, auditsGovernance Guidelines; and related matters will be referred to the Audit Committee. Interested parties may communicate anonymously if they so desire.

•

Director Nomination Process. The Nominating/maintaining, monitoring compliance with, and recommending modifications to, our Code of Business Conduct and Ethics.